Why Property

1. Anyone can do it

Property investment is not just for the wealthy. It doesn’t really take large sums of money to get involved in real estate. This is because banks will lend you up to 95% against the security of residential property, which means that most Australians with a steady job and a little capital behind them can afford to buy investment properties.

It has been shown over and over again that careful and intelligent use of real estate can enable ordinary Australians, to become “property wealthy” in about 10 years. If you truly intend to become ‘ Asset rich “ , you should take a serious look at using property to your advantage.

2. Security

You never hear of houses ‘going broke’ do you? But lots of companies have gone broke. Even companies previously considered blue chip have gone broke. Yet even allowing for the ups and downs of real estate values that we hear about, the underlying trend of property prices in the major capital city residential markets has been steady growth.

You don’t have to believe us when we say that residential property is a secure investment. Just ask the banks. Banks have always recognised property, and especially residential real estate, as an excellent security. The reason they’ll lend you up to 95% of the value of your property is that they know property values have never fallen over the long-term. In fact, the entire Australian banking system is underpinned by the continual growth of residential property.

3. Income that grows

The Rental income you receive from your investment property allows you to borrow and gain the benefit of leverage by helping you pay the interest on your mortgage. Over the years the rental income received from property investments has increased at a rate that has outpaced inflation.

The Government is having difficulty providing public housing, which means there will be plenty of opportunities for landlords to make good money in residential property investment, particularly if you own a property that will be in demand by tenants of the future.

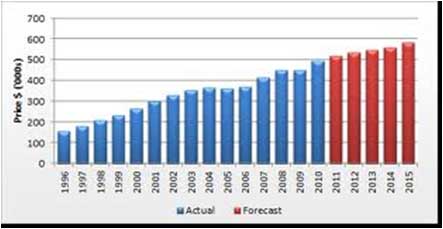

4. Consistent capital growth

Good capital city residential property has an unequalled track record of producing high and consistent capital growth. Over the past 25 years the value of the average property in all capital cities has doubled in value every 7 to 10 years.

While all our capital cities growth have averaged growth of around 8-10%, compounding each year over the last 25 years, these are just averages. The better your property selection – where you buy, what you buy, how well you negotiate and how you finance your property investment – the better your returns could be.

5. You can buy it with someone else’s money

Sure you need some of your own money – but the ability to use leverage with real estate significantly increases the return on your investment capital and, importantly, it allows you to purchase a substantially larger investment than you would normally be able to.

8. You are in control

Property is a great investment because you make all the decisions and have direct control over the returns from your property.

9. Tax benefits

Property investors are able to take advantage of a range of tax benefits including tax deductions and depreciation allowances.

Ask us and we will prepare a Investment Report for you.

10. You can add value

There are Unlimited of ways you can add value to your property, which will increase your income and your property’s worth.

11. You don’t need to sell it

Unlike most other investments, when real estate goes up in value you don’t need to sell in order to capitalise on that increased value. You simply come back to us, and we get your lender to increase your loan.